Living on Zero

Living Close to Zero

Over my years of advocating for Bitcoin, a common question I hear is, "How can one use Bitcoin to pay for goods and services?"

There are primarily three ways to do so:

- Find a merchant that accepts Bitcoin as payment.

- Use services like Bitrefill to purchase gift cards or pre-paid Visa cards.

- Save in Bitcoin and exchange it back to dollars when needed.

The first option is the simplest—you can directly use Bitcoin as money, serving as a store of value, medium of exchange, and unit of account. The second option is more cumbersome, as it requires managing multiple cards, is impractical for large purchases, and generally less convenient. The third option, while functional, involves constant expense calculations to convert Bitcoin to dollars for bill payments.

All of these methods come with the common challenge of tracking taxes on selling Bitcoin. Bitcoin is classified as property, not currency, which means every transaction requires detailed records of when Bitcoin was bought and sold to correctly calculate capital gains or losses. If you’ve never done this, trust me, it’s a daunting task unless you or your accountant understands the process well.

Our Financial Switch

In the Fall of 2021, I decided to keep only enough dollars in my checking account to cover my expenses and save the remainder of my paycheck in Bitcoin. This was a bold move, as Bitcoin peaked at $69k that year before steadily declining to a low of $16k in 2022. Despite the volatility, I understood its market behavior and monetary policy, continuing to dollar-cost average.

When Amanda and I married in 2023, we faced the question of what to do with our combined savings. After extensive conversations in our dating time, which she loved, Amanda trusted me to move our savings into Bitcoin and adopt this financial model for our family.

For years, I’ve aspired to live on Bitcoin as the money I use. My motivations stem from my conviction about money. Yet, the traditional financial system makes this difficult. Most businesses don’t accept Bitcoin, banks don’t operate on Bitcoin, and taxes must be paid to the US government in fiat currency. I’ve long dreamed of the day I could pay for something as simple as a Chick-fil-A sandwich using Bitcoin.

That day is now closer.

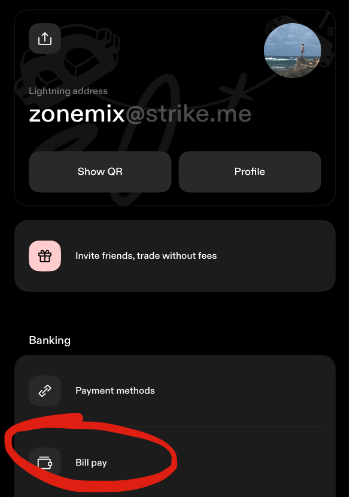

Enter Strike

Recently, Strike introduced its Bill Pay feature, which allows users to pay bills directly through their affiliated Cross River Bank account. For those unfamiliar, Strike is a Bitcoin-powered global payments app enabling users in 70+ countries around the world to buy, sell, send, and receive cash and Bitcoin.

Strike utilizes the Bitcoin network to send cash over the Bitcoin rails without you ever needing to hold Bitcoin yourself, empowering millions of individuals in the world to send money to each other in their native currencies. You can't do this with platforms like Venmo (only US) or Cash App (US and UK) because they were built to primarily work on the traditional finance rails.

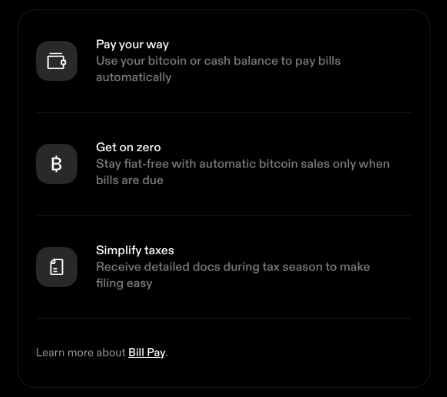

Strike as a "bank" is nothing new. It has supported direct deposits, wire transfers, and ACH payments for years, but its Bill Pay feature is a game changer. Users can now pay bills from either their Bitcoin or cash balances, with Strike handling all the Bitcoin-to-dollar conversion and associated tax implications seamlessly.

How to Live on Zero

In our family, Strike is now our primary bank for bill payments, direct deposits (100% in Bitcoin), and savings. Outside of recurring bill pay transactions, we use credit cards like debit cards, only spending what we’ve budgeted for. This strategy allows us to take on month to month dollar-denominated debt, invest the cashback reward into Bitcoin, and hold Bitcoin until it must be spent. When bills are due, we use Strike’s Bill Pay feature to cover the expenses with our short-term Bitcoin balance. This approach ensures we maintain full Bitcoin exposure throughout the process, "living on zero" dollars.

For the debit only folks, I will explain my use of credit over debit cards in a future post. There is more than meets the eye to debit cards.

There are times we need cash or need to write a check. Luckily, Bitcoin is easy to convert back to dollars using an exchange like Strike. Once I have the dollars in Strike, I withdraw it to another traditional bank account and go to the ATM or write a check. The main inconvenience is time as ACH transfers can take a few days, but generally with Strike and the other bank, it takes about 1 day. If my other bank also worked with Bitcoin, it would take about 10 minutes or seconds if using lightning.

The Risk-Reward

Adopting this model of finances does not come without its risks. Bitcoin is known to be a volatile asset. In December 2024 alone, it has fluctuated between $92k and $108k, with many 5% swings. A negative outcome would be Bitcoin continuing to move down month to month over a long term, as we would lose value in dollar terms. A positive outcome would be the opposite.

In our budget, we allocate about 20% to savings. This serves as padding for the bad months. December is an example of a "bad month". Bitcoin opened the month at $96k and I estimate it will end around $94k, a 2-3% loss on our budget for the month. We are able to make ends meet by not saving as much for the month. If it dropped further past the 20% savings allocation in a month, then we would have to use our previous Bitcoin savings to ensure the budget is met. However, if Bitcoin then increases 20% over the next month, it covers the losses of the previous month and maybe more months prior.

With a new president-elect entering office, Bitcoin adoption accelerating, favorable macroeconomic conditions, and inflation trending upward, I believe Bitcoin has a strong chance to perform well in 2025. Observing the historical chart below, it’s clear that Bitcoin tends to follow a "3 good years, 1 bad year" cycle. This pattern isn’t coincidental, as it is tied to Bitcoin’s unique design in limited supply of 21 million units and inflation rate cutting in half approximately every four years.

If this historical pattern holds, 2024, having already seen a performance of 121%, fits as the second year in the cycle. This suggests that 2025 could also be a strong year before another correction occurs. I do not know if Bitcoin will perform well in 2025 nor if this pattern will hold as Bitcoin matures. All I do know is that God created the objective reality of math, and Bitcoin is based on that reality while our current financial system is not.

Who is this for?

I strongly believe Bitcoin should be thoughtfully considered by everyone, especially Christians. I do not recommend everyone to go all-in on Bitcoin. Never risk more than you’re willing or can afford to lose, and if you don’t fully understand Bitcoin, learn more before adopting this strategy. It would be unwise for those who are retired to go all-in on an asset they do not understand or care to learn about. Still, there remains a vital responsibility to consider the well-being of the generations that follow. Many of the opportunities granted to the generations in the past do not all apply to the generations today.

As a father now, I think about my children's future, and Lord willing, my grandchildren's futures. I aspire to support them in the ways deemed fit before the Lord. There is an opportunity cost to the decisions I make in the present that affect my children's future. I desire and pray I walk the narrow path with wisdom in the Lord's guidance to shape those decisions. As Proverbs 13:20-25 emphasizes, there is prudence and discipline to be had when raising children, and extending that care to grandchildren. Out of love, I want to position our family to give blessings both spiritually and materially to the generations to come.

After years of studying money in a biblical lens, Bitcoin is an opportunity I learned about and is a conviction I cannot unsee. I believe it is the safest asset to store my labored time into and the form of money that best adheres to the moral principles taught in the Bible. I hope and pray that it continue to be a blessing to our family, community, and church.