Living on Bitcoin – The Six Month Update

This is an update to the Living on Zero blog post from December 2024.

The Ups and Downs

Six months ago, our family embarked on the financial journey to live entirely on Bitcoin. Every paycheck is converted to bitcoin, and we live off of it for better or worse. As I shared in Living on Zero, this is about more than just trying something new—it’s a belief that Bitcoin can work as real money, even in a financial system that feels broken and inescapable. Our goal is to show it’s possible and not as overwhelming as it might seem. So far, even through the ups and downs, it is proving to work with time.

The first half of 2025 has been all over the place. Geopolitical tensions and tariff talks have markets in a frenzy. Here is a summary of everything year-to-date (YTD):

-

Bitcoin – Soared to $109k in January, fell 32% to $74k by April, rebounded 50% to a new high of $112k in May, and now hovers around $105k as June kicks off.

-

S&P 500 – Peaked at $6150, dropped 21% to $4830, and has since climbed 25% to around $6k.

-

US Treasuries (TLT) – Bonds are relatively volatile, rising 10% then falling 11%, landing roughly where they started. High bond yields aren’t exactly making life easier for everyday Americans.

-

Gold – I won't forget about you goldbugs. With an impressive run of 33% to an all-time high of $3500, it is now sitting about 5% under that at $3300. I'll come back to this later.

So, how does this affect our family? We rely on short-term, dollar-denominated debt—think credit cards—as our primary payment method. To cover monthly bills, we sell portions of our bitcoin holdings. Since our expenses are predictable and our paychecks come weekly, we can smooth out some of the volatility. But timing is everything. If bitcoin’s price dips below our average purchase price (the average price we’ve paid for our bitcoin), we’re forced to sell at a loss.

As an example, take April’s dip to $74k. Our short-term bitcoin average purchase price was around $83k, so we were selling at a loss. This was tough, as we paid a couple of bills, but it gave us a chance to buy bitcoin at a lower price. A week later, bitcoin climbed to $86k, allowing us to sell at a profit again. Moments like these are a balancing act, but they’re navigable with patience.

I want to give a shout out to the IRS for depositing our tax refund on April 6th, as it auto-converted to bitcoin at $76k, and is now up for a 40% gain 😉

The Six Month Snapshot

When we started this journey, I wanted a clear way to share what living on bitcoin looks like month-by-month, especially for those curious about the details. Plus, I wasn’t keen on sharing our transaction data with third-party tax tracking apps for bitcoin.

The IRS treats bitcoin as “property,” not money, so every buy and sell needs to be tracked for capital gains or losses.

Enter an Excel spreadsheet to track everything. It keeps our data private (not cloud hosted) and helps me break down the journey for you. Below is a month-by-month snapshot of our realized profit/loss (P/L) for bitcoin buys and sells in 2025, starting January 1st.

| Month | Realized P/L |

|---|---|

| January | 12.15% |

| February | -7% |

| March | -2% |

| April | 6% |

| May | 22% |

| *June | 23% |

Realized P/L reflects the percentage profit or loss on Bitcoin we bought and sold each month. This does not include exchange fees or unrealized gains on Bitcoin we still hold. Here’s the bigger picture:

| Average Purchase Price of Bitcoin ($) | $86,826.44 |

| Total Realized P/L | 1.86% |

| Total Unrealized P/L | 21.39% |

| Total Fees | 1.27% |

| Actual P/L | ~22% |

A 22% gain in six months beats any savings account I know, including the 2% gain in the stock market YTD. More importantly, this gain has made a real difference for our family and those around us. Here are a few ways this has helped us practically:

-

Medical Expenses – A $3k bill for my son’s corrective helmet was a big hit, but our bitcoin gains helped cover it, easing the strain on our budget.

-

Car Repairs – My wife’s car needed a new battery and crankshaft seal, costing ~$800. We paid it off with bitcoin sales, thanks to the gains we’d built up.

-

Mortgage Payments – In April 2024, we bought a $300k house with a 6.375% mortgage, costing $2337/month (including $1500 in interest). With twins and rising rates (which climbed as expected), it’s a hefty commitment, but as bitcoin is up 54% since April 2024, it eases the payment as time goes on.

The Bigger Picture

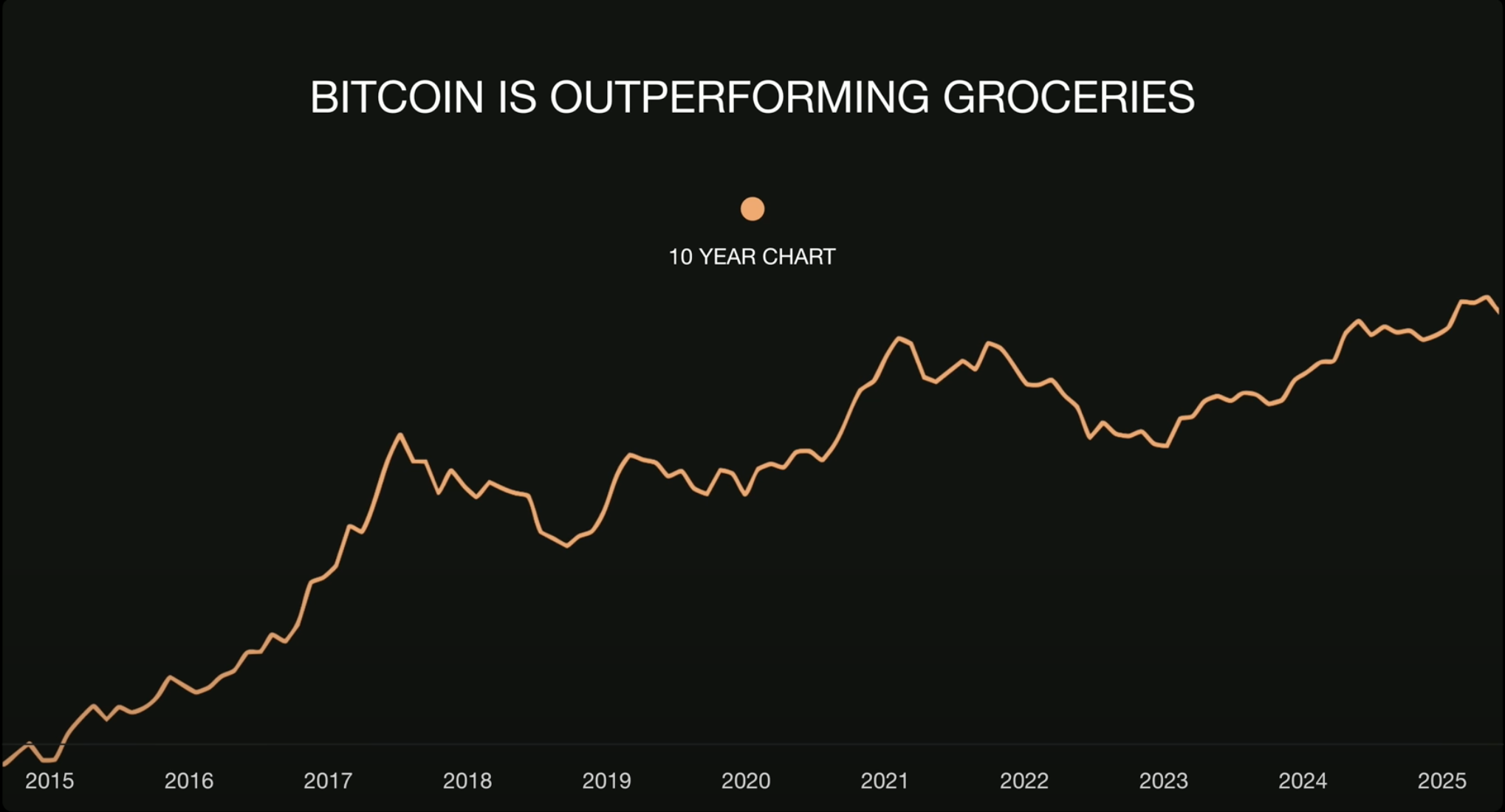

This six-month snapshot is just part of our five year journey, but when you zoom out, Bitcoin’s track record stands out. Over the years, it’s outperformed nearly every asset. I'm not a financial advisor, none of this is investment advice, but it is unfortunate most financial advisors can't even speak on this subject. I do not believe anyone should follow the Living on Zero model or go all-in on Bitcoin—not unless you have the same conviction and know what you are doing in securing your holdings. Bitcoin is volatile, especially in the short term, but with a long-term mindset, that volatility can allow for opportunity, and it can be a blessing.

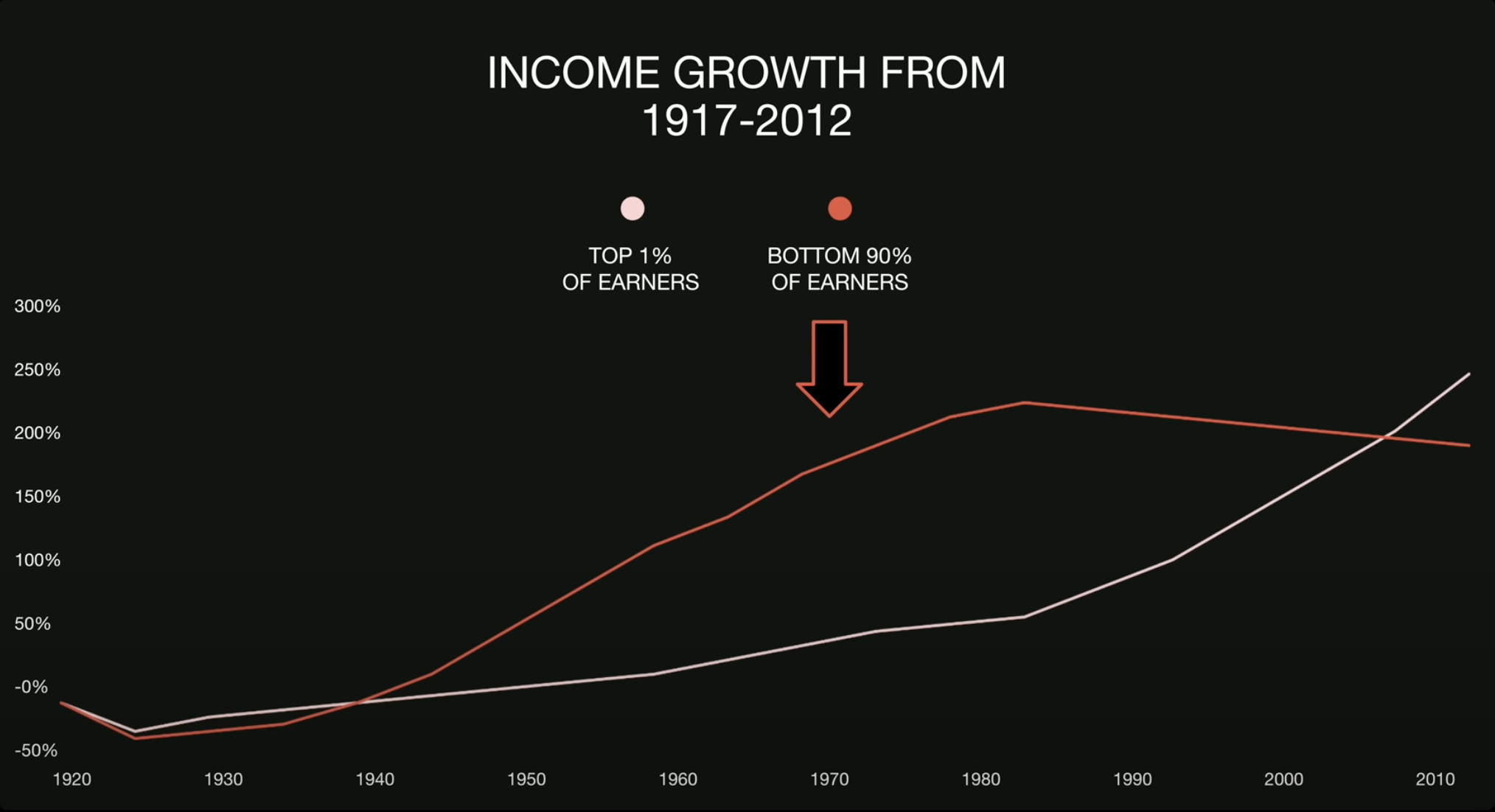

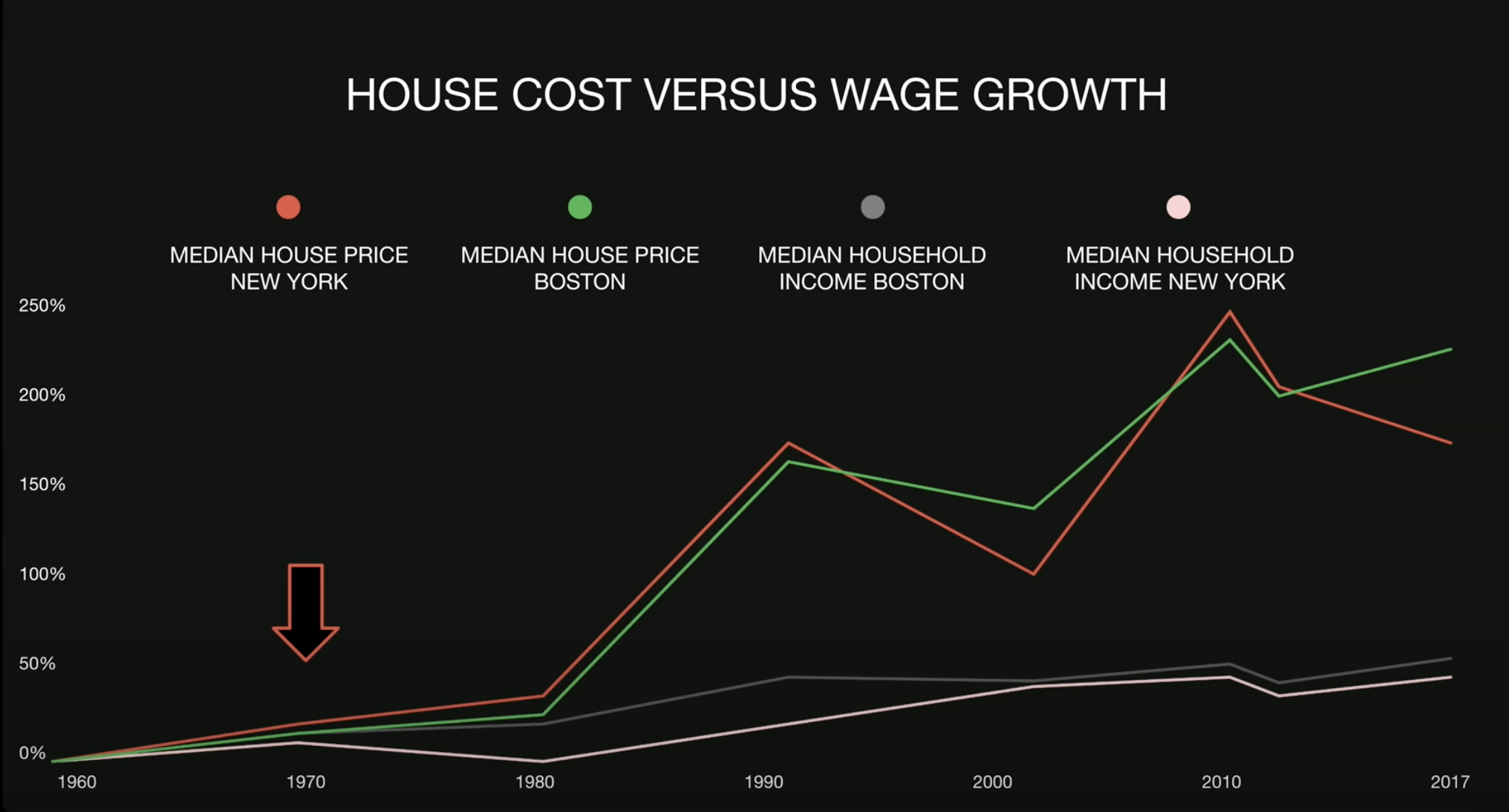

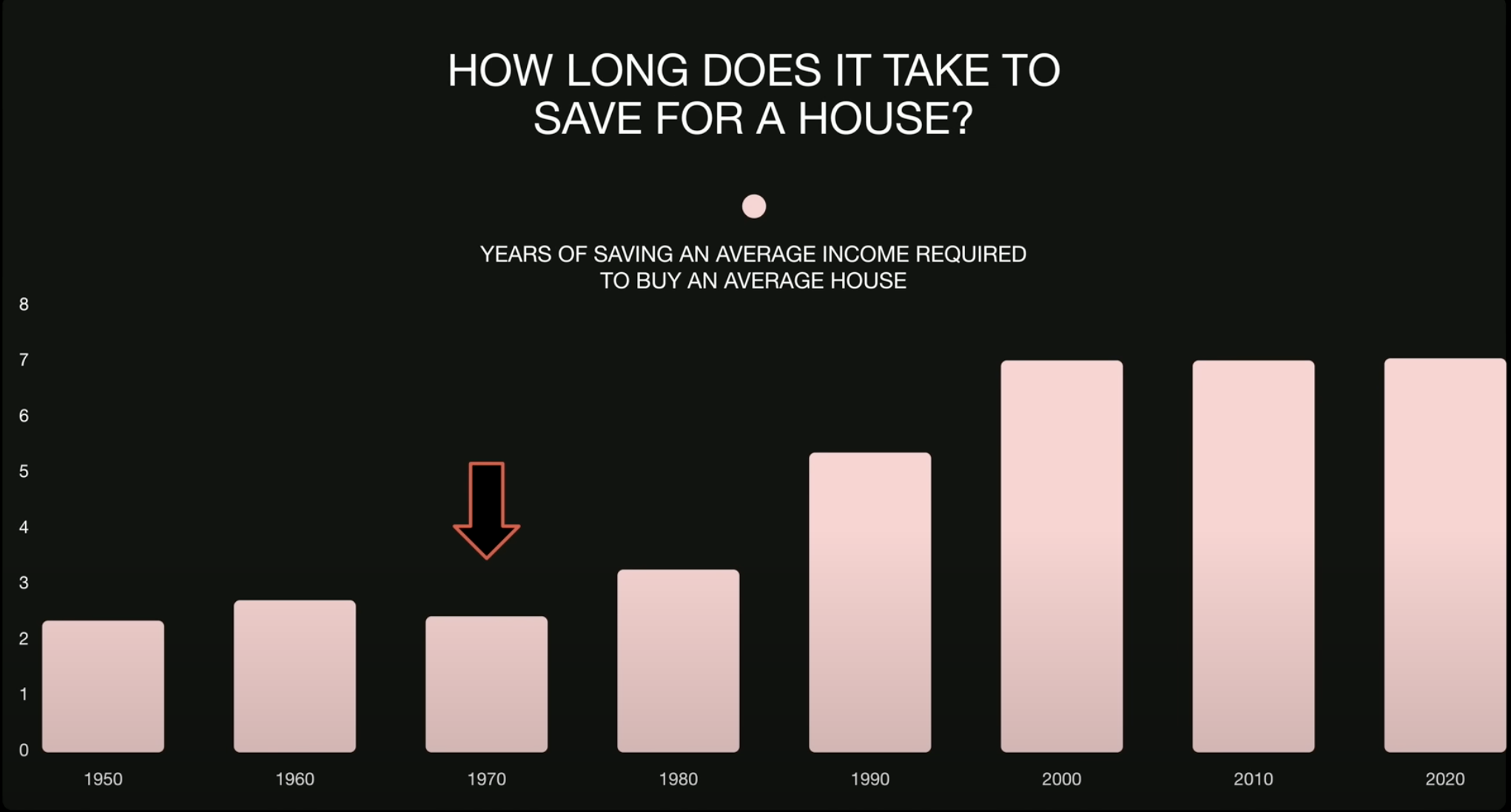

At his Bitcoin 2025 presentation, Jack Maller's of Strike shared key points for people to consider:

-

In a debt-based financial system, as government's continue to increase spending, increase deficits, and basically print money, EVERYTHING becomes more expensive due to the dollar losing purchasing power. This continues to prove true whether it is a conservative or liberal government.

-

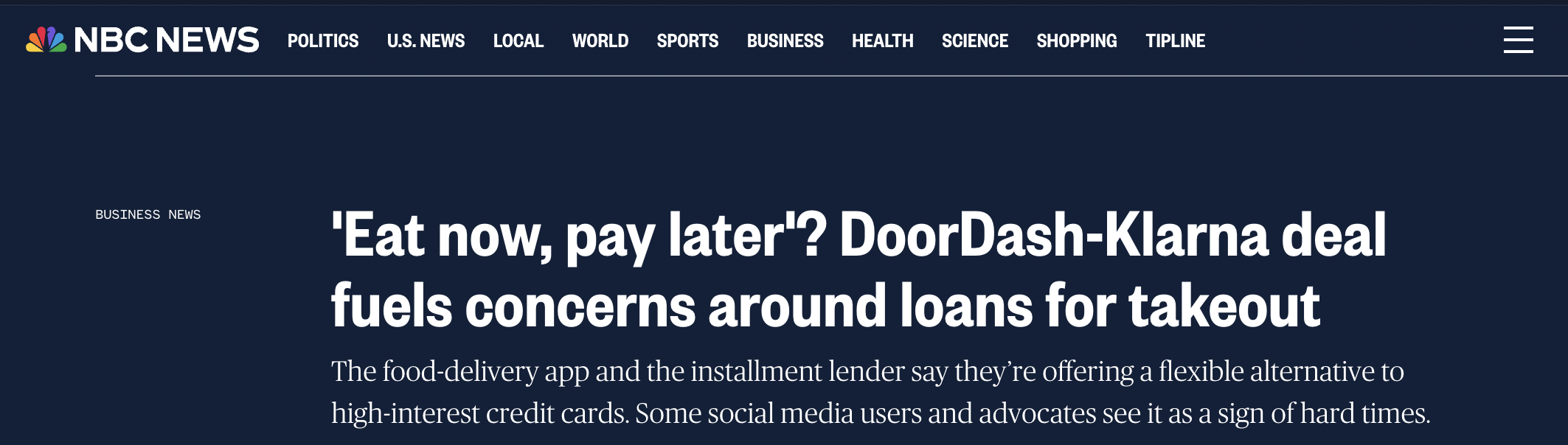

Each day that passes, more and more people are beginning to borrow money just to get by. They don't have savings or assets, just debt. They run up credit cards, take out unnecessary student loans, and continue to fall in the consumer mindset of "buy now, pay later".

-

Household debt now stands at a staggering $18.2T, credit card balances at $1.1T, our US debt approaches $37T with our interest expense now over $1T with no sign of slowing down (One Big Beautiful Bill Act).

-

Wages don't keep up, so the lower classes continue to be pushed down, carrying the weight of a broken system.

Here are some slides from the presentation. The arrow indicates the 1971 divorce from the dollar-gold standard.

This one below is wild to me. What world do we live in where you can take a loan to have food delivered to you?

Maller's also brings up a quote dating back to ~1800AD to show how forward thinking the founders of the United States were. Whether you agree more with Alexander Hamilton or Thomas Jefferson, I'm not sure either of them would agree with how our financial systems are run today. This quote shows the reality we are in and moving further into.

"If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered… I believe that banking institutions are more dangerous to our liberties than standing armies… The issuing power should be taken from the banks and restored to the people, to whom it properly belongs." — Thomas Jefferson

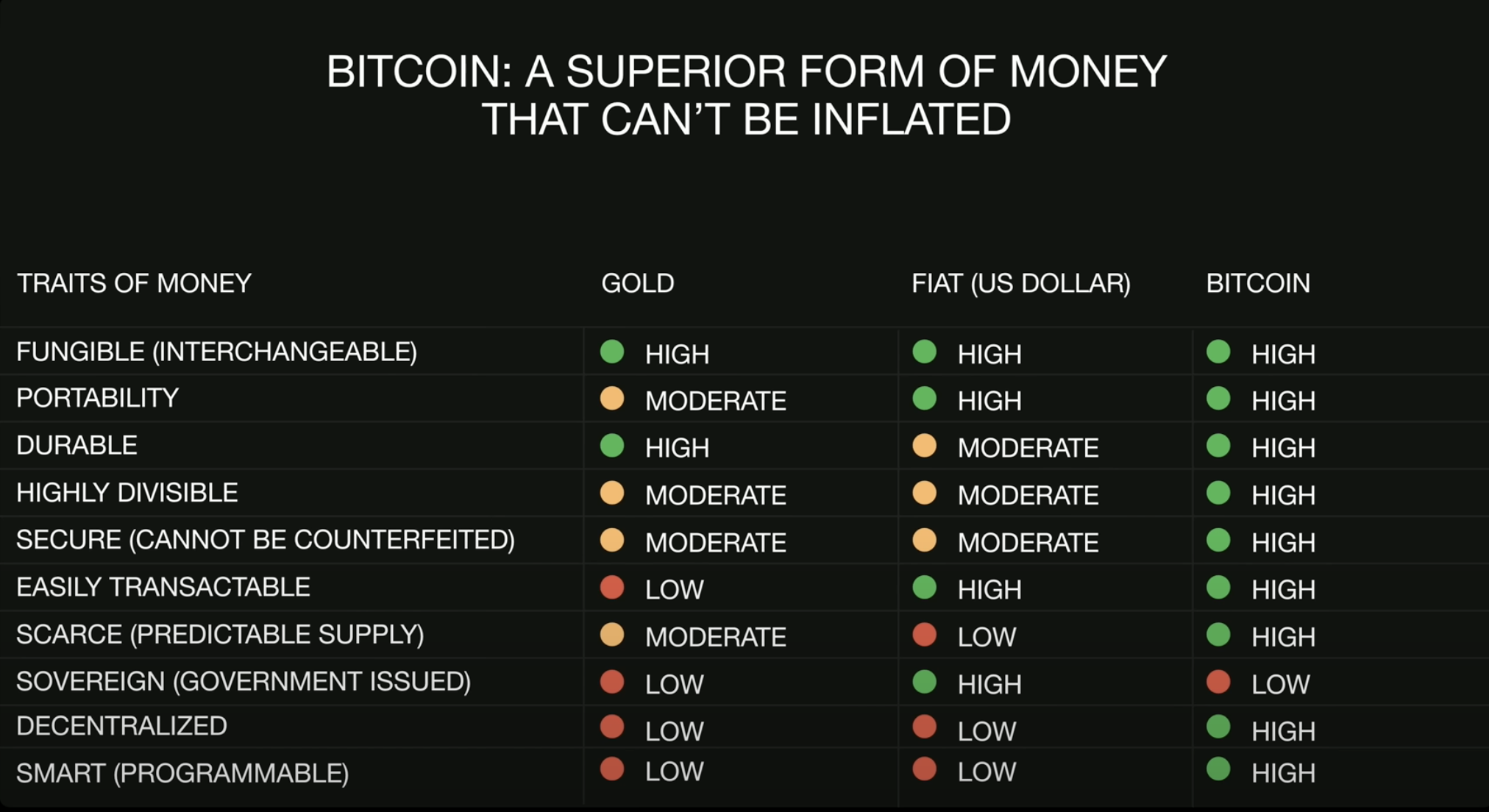

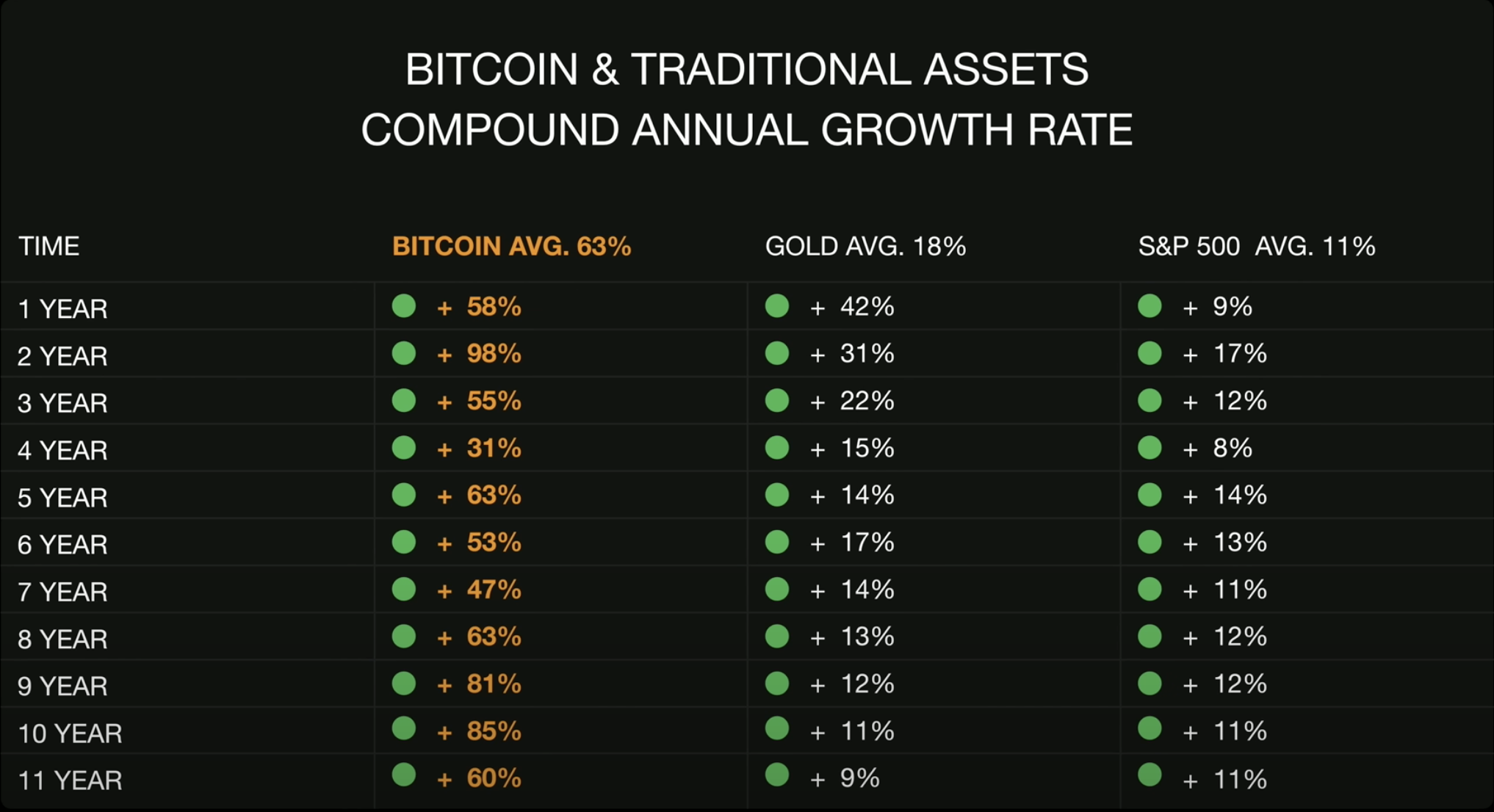

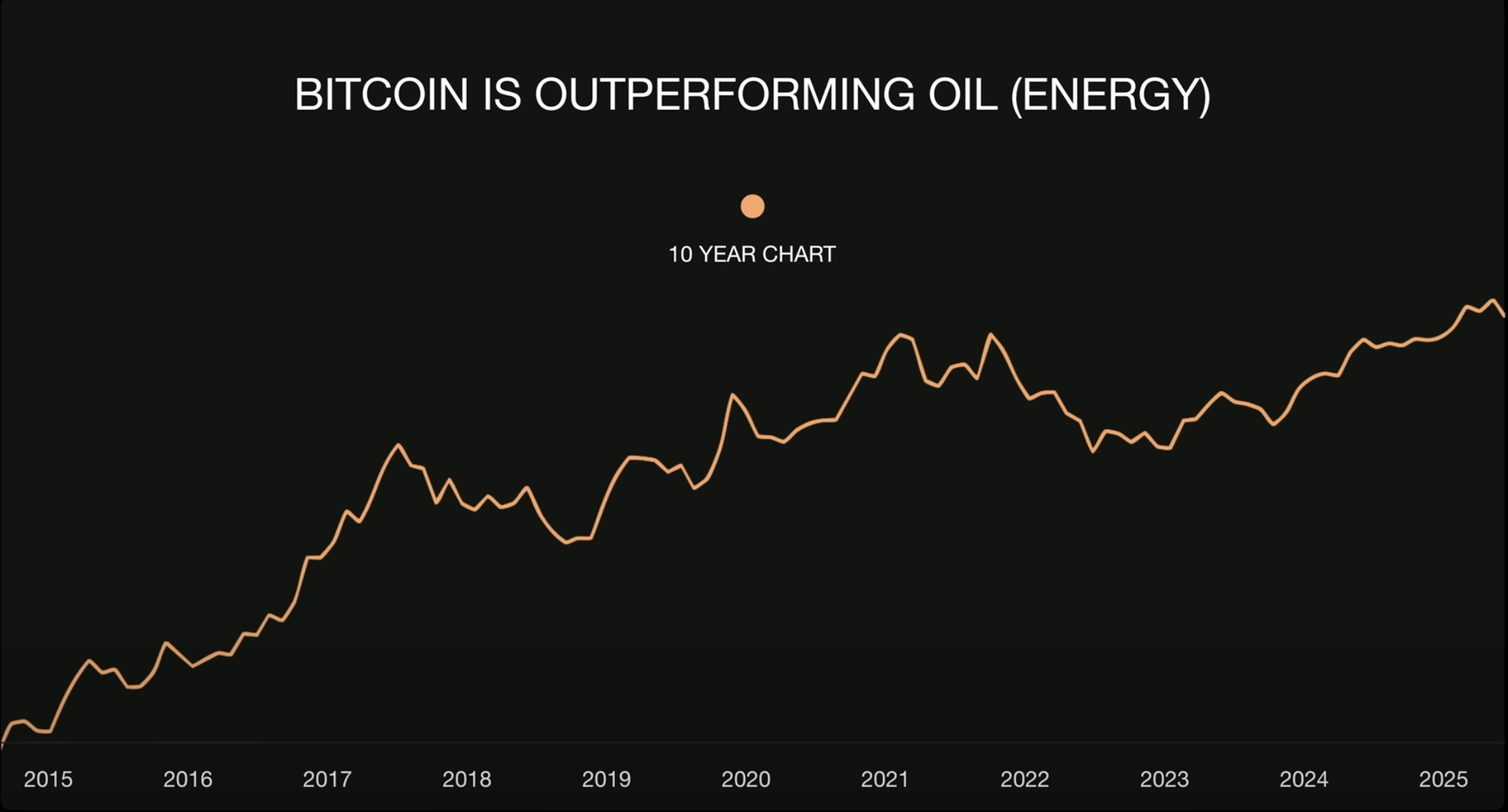

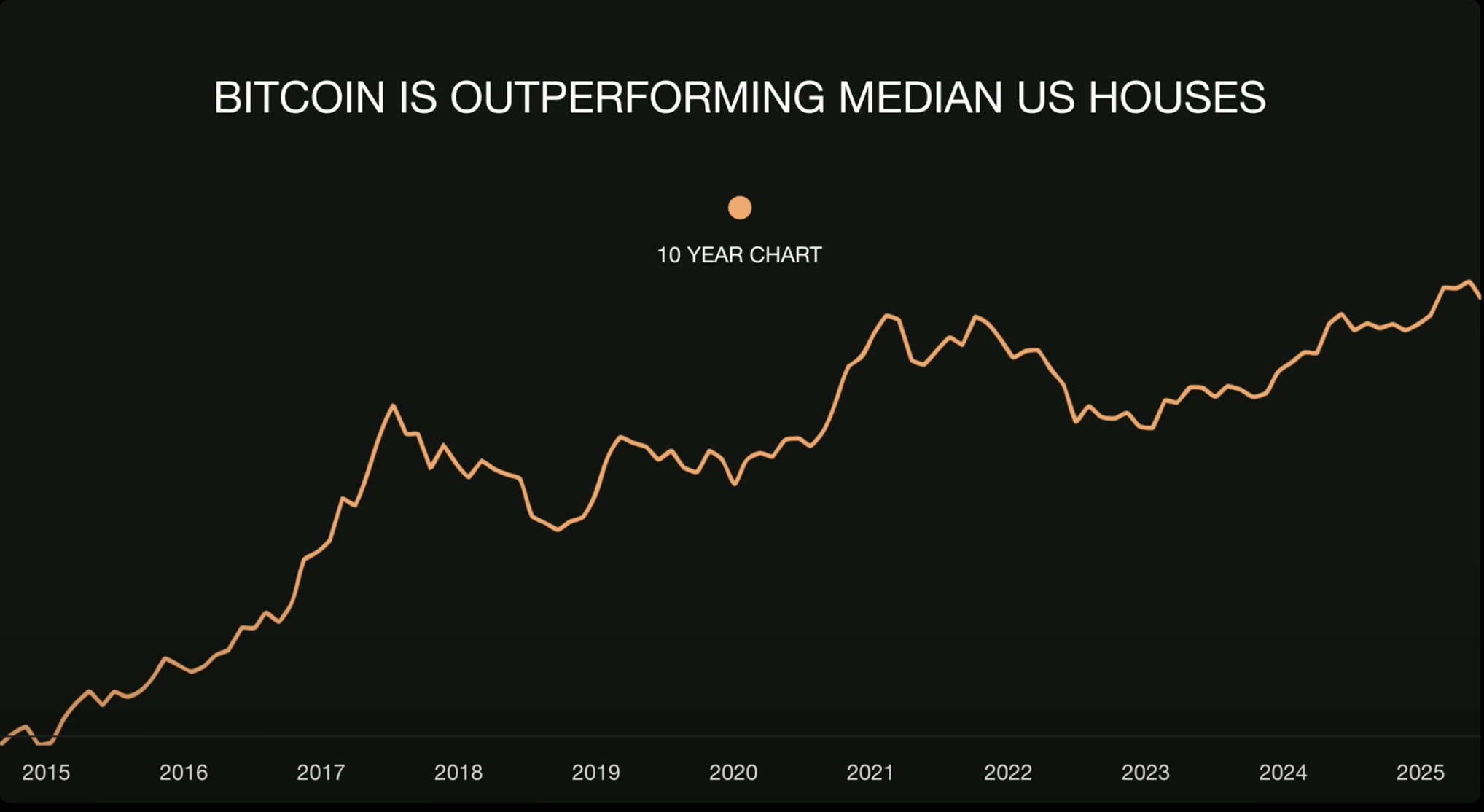

In his final slides, when we look at bitcoin's characteristics and performance against other assets, I think it paints a helpful picture.

As a Christian, in testing our financial system against scripture, I don’t believe it aligns with biblical principles. Even if you are not a Christian, these are things to consider for everyone as time goes on. This begs the question, is there a better way?

The Next Step for Bitcoin

I don’t know if Bitcoin will continue its trend upwards, but monetary shifts like this aren’t new in human history. From barter, to coinage, to silver and gold, to only gold, to fiat now, systems evolve, and Bitcoin’s growing popularity worldwide shows it’s part of that change.

In 2025, Bitcoin took a huge leap as a form of payment. Thanks to stability in its layer-2 technology, the Lightning Network, more institutions are adopting Bitcoin for transactions, making it a practical alternative to traditional money. This is exciting for our family! This now isn't just about taking on short-term dollar denominated debt and selling our bitcoin to pay the bills, but using it in everyday life!

Here are some highlights to share:

- Square announced Bitcoin Lightning payments are coming to all Square Point-of-Sale terminals in 2026.

- More online stores are starting to show "Pay with Bitcoin Lightning", like Heart and Soil Supplements.

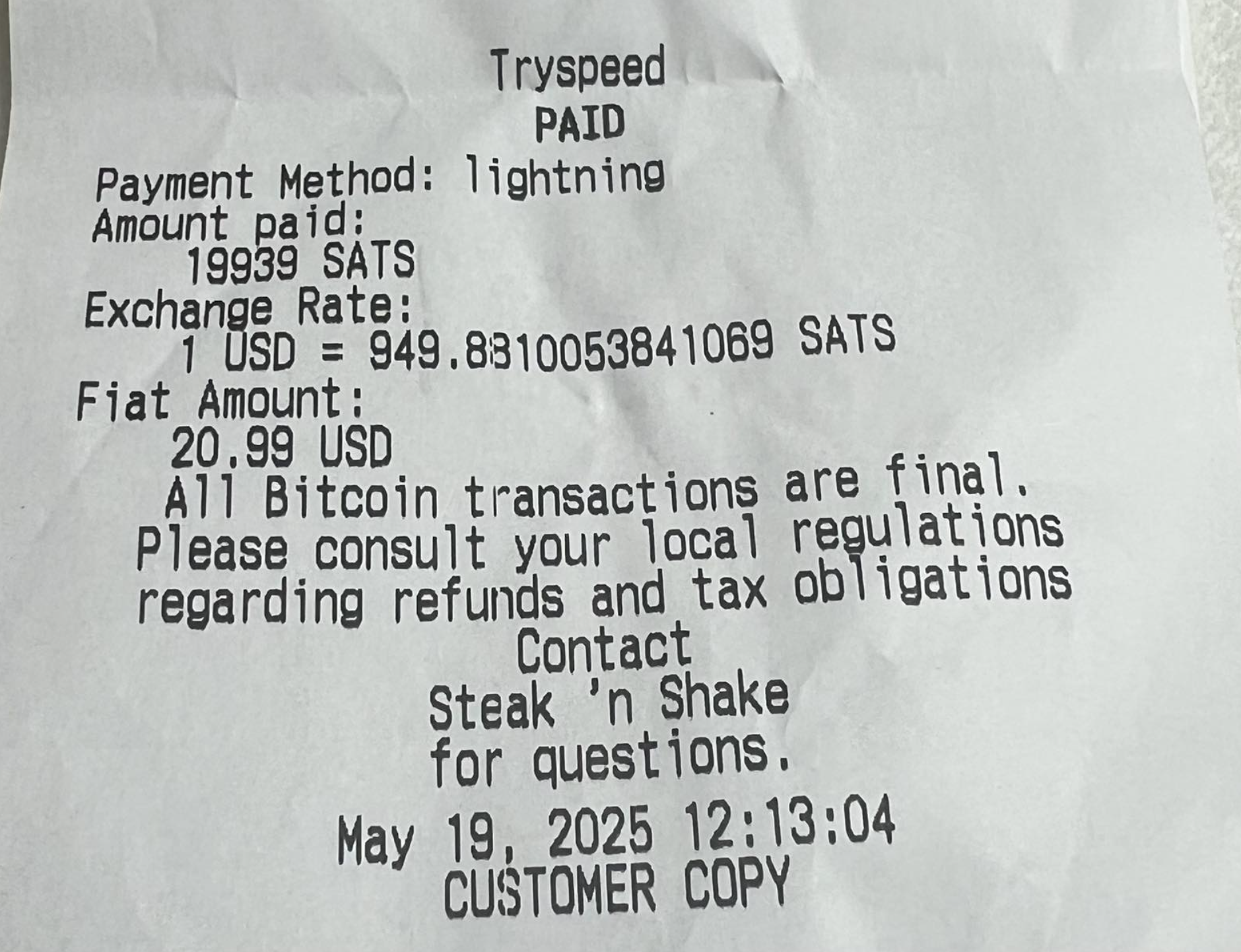

- Steak 'n Shake is the first major fast-food chain to accept Bitcoin. I even had the chance to go to one in Kentucky to buy our food with Bitcoin Lightning!

TipThere are tax considerations to paying for things with Bitcoin, however, it is possible to pay with dollars over bitcoin with Strike. With the cash wallet's "send" feature, you can avoid tax annoyances. Due to the instant buy/sell conversion happening on the backend, there are ZERO capital gains/losses to report for the transaction.

In conclusion, money is not a means to an end. It is just a tool to help out in the time I am on this earth. I am incredibly grateful for this journey and how God is using it to help me grow in my reliance and trust in him. I continue to hope and pray that it be a blessing to our family, community, and church.

If you ever have any questions, you can always reach out to me here. Here is a helpful resource to learn about bitcoin in 21 minutes.